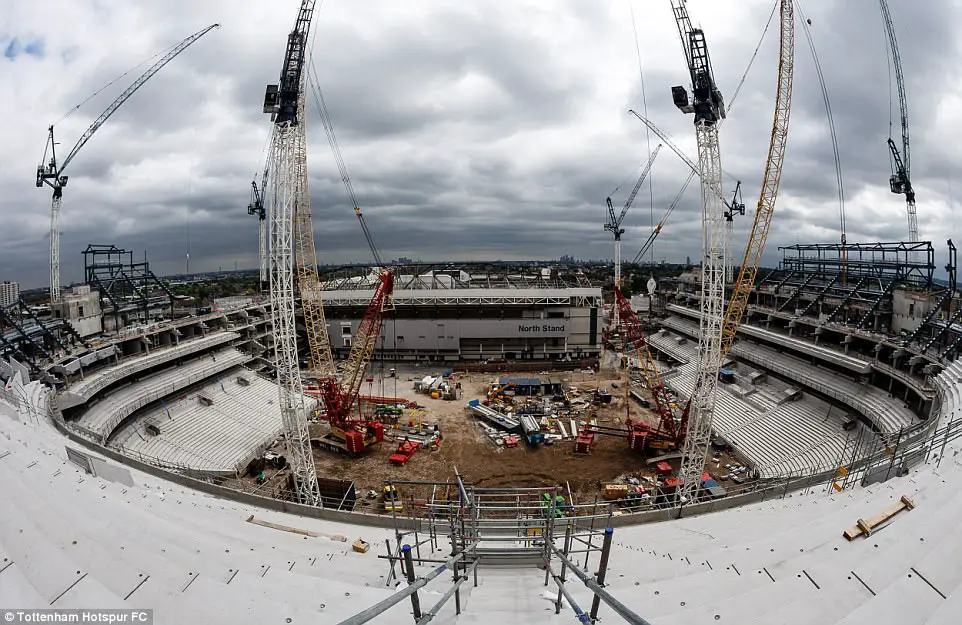

Now, this is some happy news for all of us! We are all aware of the Northumberland Development Project that is happening at a rapid speed. If things go as planned, the stadium will be ready for use in the 2018/19 season.

The new stadium is set to be one of the best in the country and probably even in Europe and the numbers are mind-boggling. The stadium reportedly costs £800million and will have more seating capacity than that of Arsenal’s Emirates Stadium.

The latest update regarding the massive move was revealed by the club and the announcement is that Tottenham have signed a five-year bank financing arrangement which includes a £400m bank facility (the “Facility”) to support the financing of the 61,500 seater multi-purpose new stadium, the Tottenham Experience and the largest retail store of any football club in Europe.

This is a massive announcement considering the financial part of the stadium construction and it probably comes at a right time when the work needs to be done quickly. Now that Tottenham will be playing at the Wembley stadium next season, it is important that the construction of the stadium gets completed quickly and the finances should be of massive help.

The announcement from the club read:

“The Facility will replace a £200m interim financing (the “Interim Financing”) that was put in place in December 2015, of which £100m has been drawn to date. The Interim Financing provided funding for the Club whilst relocation, planning and development conditions were completed, to ensure the project remained on schedule.

Bank of America Merrill Lynch International Limited, Goldman Sachs Bank USA and HSBC Bank plc are the lenders under the Facility, and were also the lenders under the Interim Financing. In addition, HSBC are providing a £25m working capital facility to the Club as part of the new financing arrangement.

The Club has expended over £340m on the acquisition of land, the planning process (including a compulsory purchase order and legal challenges) and build costs to date, which now sees the upper tiers of the North stand being fitted with terracing. This was financed with resources of the Club plus the £100m drawn under the Interim Financing.

The remaining costs of the project will be funded from the Facility and the Club. In addition, the ENIC Group will also commit to a £50m letter of credit facility to support the stadium financing and ensure the project is fully funded through the course of its build.

The Facility has a term of five years, with no early repayment penalties or amortisation requirements and no material financial covenants until the stadium opens. The loan is secured against the new stadium and related commercial and match day revenues. There is no obligation to hedge under the Facility and the margin cost payable on the Facility ranges from Libor plus 3% -2.25% over the term.

Rothschild & Co are the Club’s financial advisor on both the Interim Financing and the Facility, with Slaughter and May acting as legal advisor on the financing and construction aspects and DLA Piper acting for the lenders.”

As time flies by, the excitement regarding the move to the new stadium keeps increasing and personally, I cannot wait to see the construction of the stadium to get completed. The move would undoubtedly mark our entry into Europe’s elite in terms of facilities and value.